China’s zero-Covid policy is putting severe strain on supply chains across the country with factories and warehouses being frequently shut down for short periods and trucks sometimes being stopped from travelling.

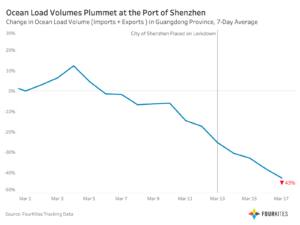

At Shenzhen, normally the country’s second busiest port, figures released by supply chain visibility expert FourKites reveal a trend of sharply declining volumes, not just in the last week as the city went into full lock-down, but over the last three weeks as authorities there have taken measures to stop the spread of Covid-19 in the latest outbreak.

FourKites predicts that some suppliers and carriers will move to other ports and take the hit of significantly longer over-land routes to get there. However, the situation is volatile and it’s impossible to predict whether — and where — there may be other Covid-19 restrictions.

FourKites predicts that some suppliers and carriers will move to other ports and take the hit of significantly longer over-land routes to get there. However, the situation is volatile and it’s impossible to predict whether — and where — there may be other Covid-19 restrictions.

With delays in other parts of the world, notably the US ports that Shenzhen serves, Covid-19 restrictions at the Chinese port may not represent the worst bottle neck. It may not be worth rerouting, if goods must sit on ships for two weeks anyway before they are able to depart for the US. Chinese lock-downs tend to be short lived and so waiting it out may also be an option for users of Shenzhen.

The fact that dwell times have not shot up as volumes have gone down suggests that shippers are becoming more agile in their reactions to supply chain issues. They are not simply changing routes, sometimes they are changing the factories they source from, to keep supplies moving.

Constant change is a given these days and, for transport professionals, volatility and increasing costs are just part of the job. They will have to keep a close eye on the situation, and particularly how long Shenzhen restrictions may last, and be ready to adapt.

- FourKites has seen impacts to ocean freight volume following the recent lockdown of the City of Shenzhen due to increasing COVID-19 cases.

- In Guangdong Province (where the City of Shenzhen is located), 7-day average ocean load volume for both imports and exports is down 43% since 1 March. On 17 March, the 7-day average load volume was down 39% week-over-week.

- Dwell times at the Port of Shenzhen remain stable, hovering around 8.3 days for exports and 5.1 days for imports, though dwell times will likely increase over the coming days as throughput decreases.

The post Volumes plummet at Port of Shenzhen appeared first on Logistics Business® Magazine.